Strong M&A Market Expected in 2024

Capital West Partners, a leading Canadian M&A advisory firm, expects a robust M&A market in 2024. Many business owners took a “wait and see” approach in 2023, awaiting an improved economic and capital market environment to pursue an M&A transaction, evident in the decline in North American deal volume. Similarly, many acquirers took the same approach. As the economic and capital market outlook stabilizes this year, more buyers and sellers are expected to aggressively re-enter the M&A market, helping to drive M&A volumes during the year.

Within Canada, indicators of positive economic growth, such as declining unemployment rates and lower inflation, will allow for a soft landing from any potential recession. With the combination of expected interest cuts later in the year, record amounts of private equity dry powder, strong strategic buyer interest in acquisitions, and demographics driving increased succession planning activity for privately owned businesses, we expect healthy deal activity and higher deal valuations in the Canadian mid-market this year:

Inflation and Interest Rate Stabilization

The instability of rapidly increasing interest rates and inflation over the past two years have been the main contributors to the decline in M&A activity, as debt used to fund transactions became more expensive. The consensus from economists is for rate cuts in 2024, given the Canadian Consumer Price Index peaked at 8.1% in June 2022 and subsided to 3.4% in December 2023.

Consumer Price Index 12-Month % Change

Source: Bank of Canada

The Federal Reserve expects inflation to continue falling closer to its target of 2% in 2024, with inflation in Canada likely to follow suit. This ease in inflation has not been accompanied by a significant rise in unemployment, a sign of overall economic health, and in combination with declining interest rates, will lead to greater interest from acquirers to drive deal volumes and valuations.

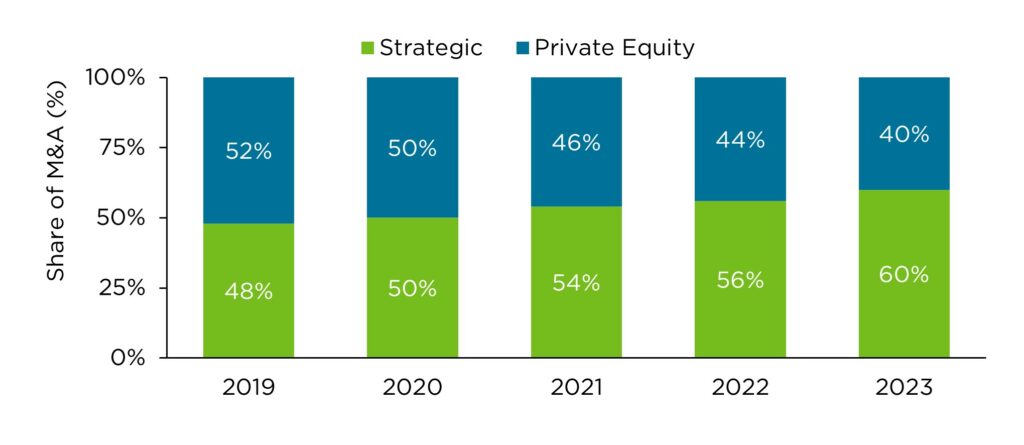

Increasing Proportion of Strategic M&A and Record Private Equity Dry Powder

Strategic buyers’ proportionate share of M&A has increased in recent years as companies pursue targeted acquisitions to accelerate growth and complement existing operations.

Strategic vs. Private Equity Share of North American M&A

Source: Capital IQ

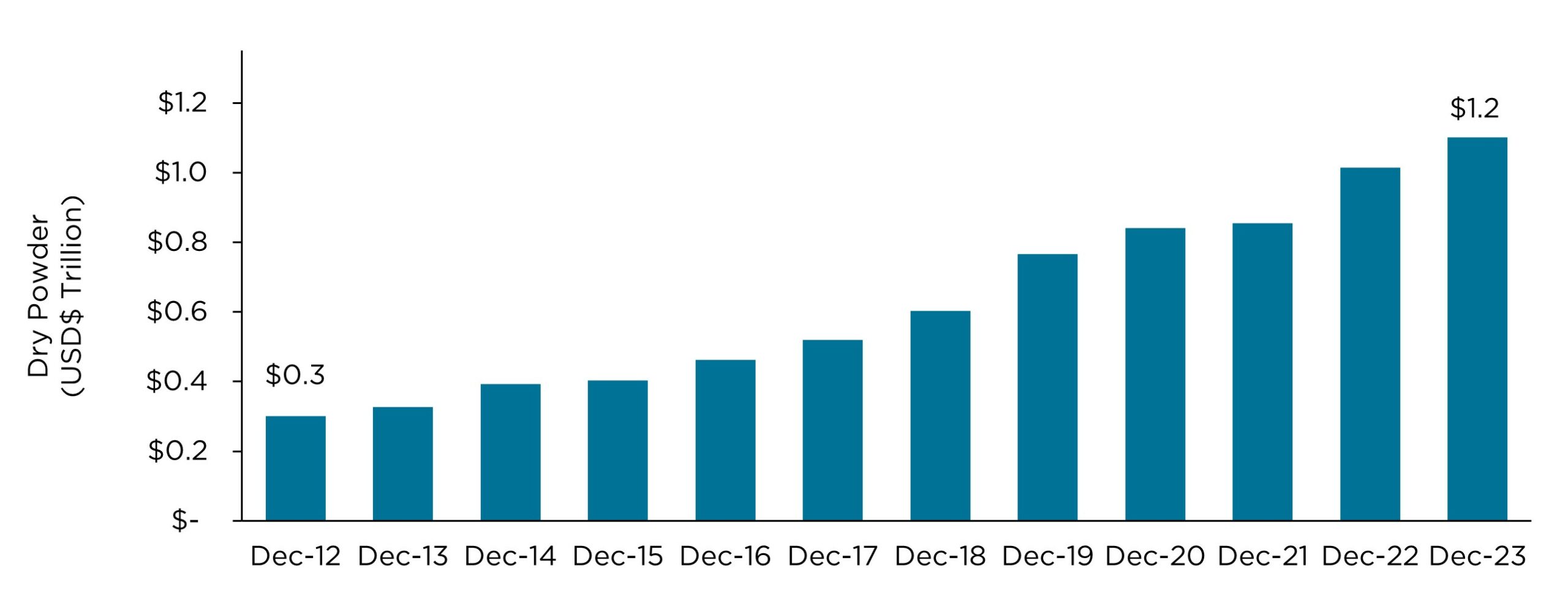

North American private equity firms continue to have record levels of undeployed committed capital that they will be motivated to invest in 2024 as the economic environment stabilizes (USD$1.2 trillion in dry powder at the end of 2023).

Dry Powder Held by North American Private Equity Funds

Source: Capital IQ

Succession Planning

M&A volumes in the mid-market will be driven in large part by the increasing number of business owners reaching the age where they want to retire. Surveys of mid-market business owners indicate that transaction planning activity has recently picked up, which is a leading indicator of mid-market M&A volumes.

About Capital West Partners

Capital West Partners is a leading independent transaction advisory firm based in Vancouver, BC. As mid-market M&A specialists, we deliver focused financial advice and transaction expertise to Western Canadian companies across a range of transaction situations, including:

- Divestitures

- Mergers & Acquisitions

- Strategic Financings

- Valuations & Fairness Opinions

- Financial Advisory Assignments

Capital West has a proven track record of 30+ years of completing transactions that maximize value for our clients. Since inception, we have completed deals worth over $11 billion in total value.

Capital West is also a proud partner in IMAP (International Mergers and Acquisitions Partnership), a global organization of highly experienced mid-market advisory firms in over 40 countries with a track record of 50 years. Through IMAP, we maximize our global reach to bring industry and country expertise to every one of our assignments, and to find our clients the best buyers and investors in North America and beyond. www.imap.com

Subscribe to Capital West Quarterly Newsletter

For more Canadian M&A insights and market updates, subscribe below to receive Capital West’s quarterly newsletter, “Deals West”.