The Year Ahead for M&A in Canada

Capital West, a leading transaction advisory firm in Western Canada, expects a strong year for mid-market M&A in 2025, with high-quality mid-market businesses continuing to receive attractive valuations in well-run, competitive sale processes. Some of the factors that will impact mid-market M&A activity are noted below:

Positives

Interest Rate Reductions

Recent interest rate cuts and lower inflation have started to foster investor optimism. Further expected cuts will increase this optimism and drive transaction volumes.

Narrowing Valuation Gaps

Valuation Gaps between buyers and sellers for second tier assets have narrowed, following softer M&A in 2023 / early 2024. Price alignment will drive M&A volumes as buyers and sellers revise expectations.

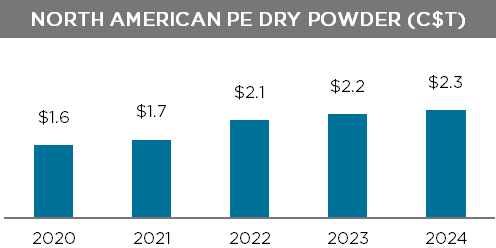

Record Levels of Dry Powder

Private equity dry powder continues to increase to record levels, now at $2.3T in North America alone.

Importance of Succession Planning

Over half of Canadian business owners plan to exit their business within the next five years. As a result, the pace of ownership transfer will increase.

Private Equity Exits to Double in 2025

Lower cost of capital and a more receptive IPO market are creating a better environment for PE exits which increased ~50% in 2024. PE exits are expected to double in 2025.

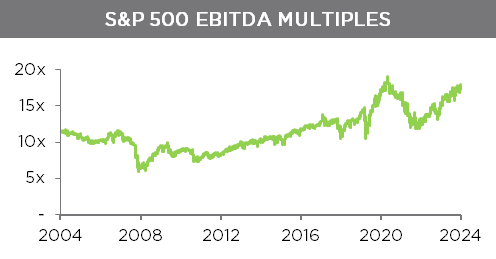

Strong Public Market Valuations

M&A valuations are often supported by public markets. High public multiples will support high M&A valuations and bring more sellers to market.

Uncertainties

Geopolitical Environment

Threat of tariffs proposed by the incoming US administration has the potential to negatively impact the Canadian and global economy. This uncertainty around tariffs and North American free trade may cause transaction delays in sectors adversely affected by US tariffs.

As one of Western Canada’s most active transaction advisory firms in the mid-market, Capital West helps entrepreneurs plan, negotiate, and complete major transactions such as business sales, acquisitions, and strategic financings. We have successfully closed transactions totaling $10 billion for clients such as lululemon, Aritzia, Canfor, A&W, The Keg, and Harbour Air, among many others. With 2025 M&A activity expected to continue the momentum seen in the last half of 2024, it is never too early to consider your business exit strategy. Reach out to one of our partners for a discussion on how to best prepare and entering the market for a transaction.