Tariffs and M&A: Impacts & Opportunities

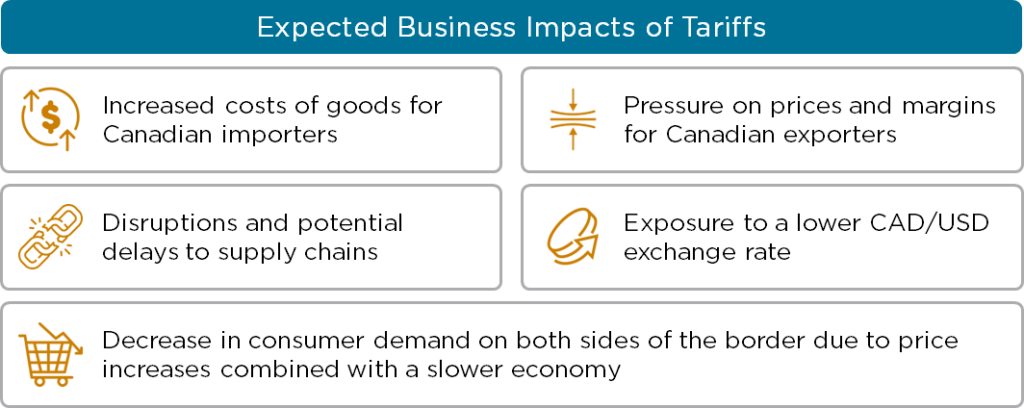

The recent announcement of US tariffs on Canadian goods and threatened retaliatory tariffs by the Canadian government has created angst and uncertainty, which is resulting in a slow-down in mid-market M&A activity. Buyers are reassessing their acquisition criteria while sellers are evaluating the potential challenges of tariffs on their businesses. Capital West Partners, a leading M&A advisor in Western Canada, expects some of these challenges to include:

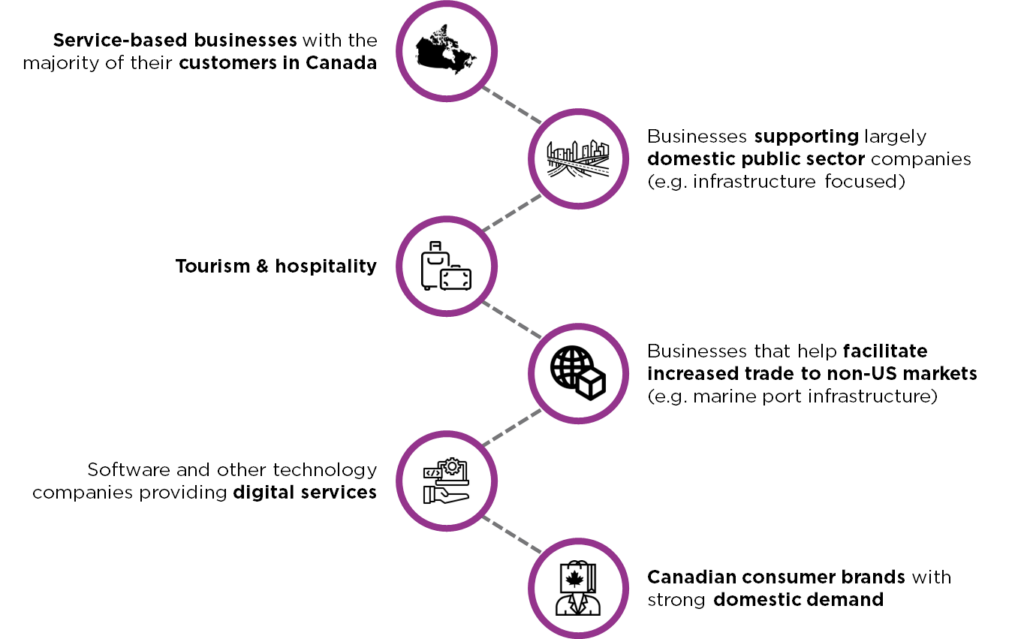

However, it’s not bad news for all Canadian M&A market participants. During this time of limited acquisition opportunities, Canadian businesses less impacted (or even positively impacted) by tariffs can now be positioned as an even more desirable target. This includes businesses in the following sectors:

Private equity firms continue to focus on deploying the record amount of committed capital built up from recent years. The anticipated slower economic growth will also prompt strategic buyers to utilize their strong balance sheets to pursue growth through acquisitions. As a result, businesses in the above sectors will garner substantial interest and be highly sought after in the current M&A environment.

In times of economic uncertainty such as today, resilient, high-quality businesses are expected to withstand the challenging M&A market impacts with the right positioning and the guidance of an experienced M&A advisor. As one of the most active mid-market M&A advisors in Western Canada, Capital West helps entrepreneurs plan, negotiate, and complete major transactions such as business sales, acquisitions, and strategic financings (see our track record here). Reach out to one of our partners for a discussion on how to best prepare your business for entering the M&A market this year.

About Capital West Partners

Capital West Partners is a leading independent transaction advisory firm based in Vancouver, BC. As mid-market M&A specialists, we deliver focused financial advice and transaction expertise to Western Canadian companies across a range of transaction situations, including:

- Divestitures

- Mergers & Acquisitions

- Strategic Financings

- Valuations & Fairness Opinions

- Financial Advisory Assignments

Capital West has a proven track record of 30+ years of completing transactions that maximize value for our clients. Since inception, we have completed deals worth over $11 billion in total value.

Capital West is also a proud partner in IMAP (International Mergers and Acquisitions Partnership), a global organization of highly experienced mid-market advisory firms in over 40 countries with a track record of 50 years. Through IMAP, we maximize our global reach to bring industry and country expertise to every one of our assignments, and to find our clients the best buyers and investors in North America and beyond. www.imap.com